Value of the insured vehicle. The amount of coverage.

Insurance Myth 2 Car Color Doesn T Affect Your Insurance Rates For Any Other Auto Insurance Questions Contact Us At 815 6 Car Cost Car Colors Car Insurance

Your age and gender.

. Which of the following affects ones car insurance premium. People with low insurance scores may be seen as a financial risk by insurers much the same way lenders look at those with poor credit numbers. As time goes on the effect of past collisions on your premiums will decrease.

High moving violation fines for speeding. Your driver classification including age sex marital status driving record and driving habits. Lowering the insurance premium.

Teen drivers also tend to pay more in premiums than older more experienced drivers. The more miles you. An important thing to understand about auto insurance and points is that insurance companies dont look at a drivers points tally to determine their insurance rate.

If you are insured and accident-free for 3 years you likely qualify for a State Farm accident-free savings. For information on coverage types coverage limits and deductibles see Buying. The higher the value of the car the higher the premium b.

The biggest factors that affect car insurance rates are state coverage requirements age and the cars make and model. ANumber of miles driven. BYear in which the car was purchased.

Your Age and Gender Your age and gender may also impact your car insurance premium. The more coverage youre required to buy in your state and the more valuable your vehicle is the more youll pay for car insurance. What vehicle you choose to drive.

Policies with large deductible provisions. And even though you cant rewrite your driving history having an accident on your record can be an important reminder to always drive with caution and care. Where you live and.

Younger drivers have less experience and pay higher premiums. Apart from your car and how you drive it two key factors that affect the premium are your no claim discount and the level of your voluntary excess. Explain the factors used to determine the automobile insurance premiums a person pays.

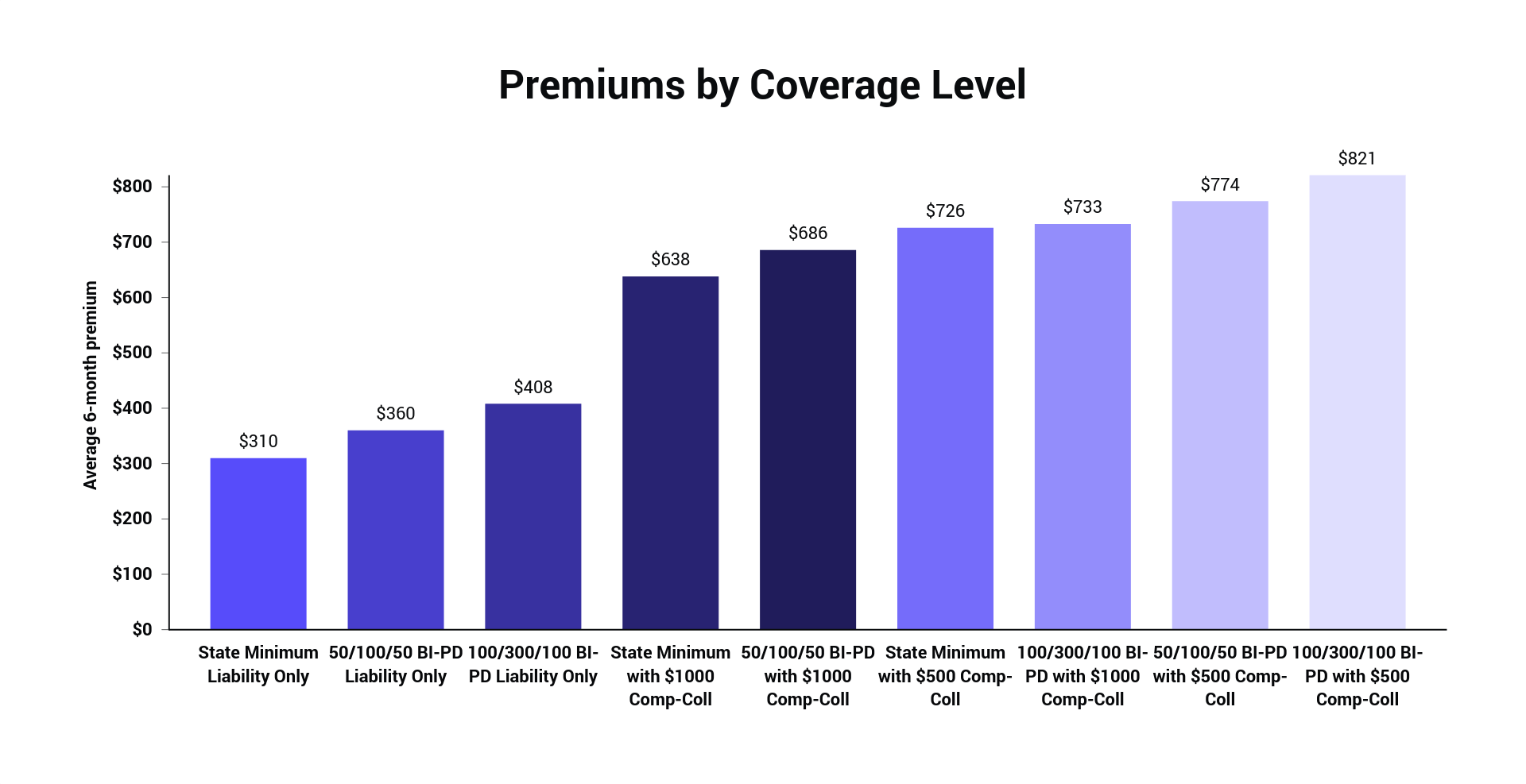

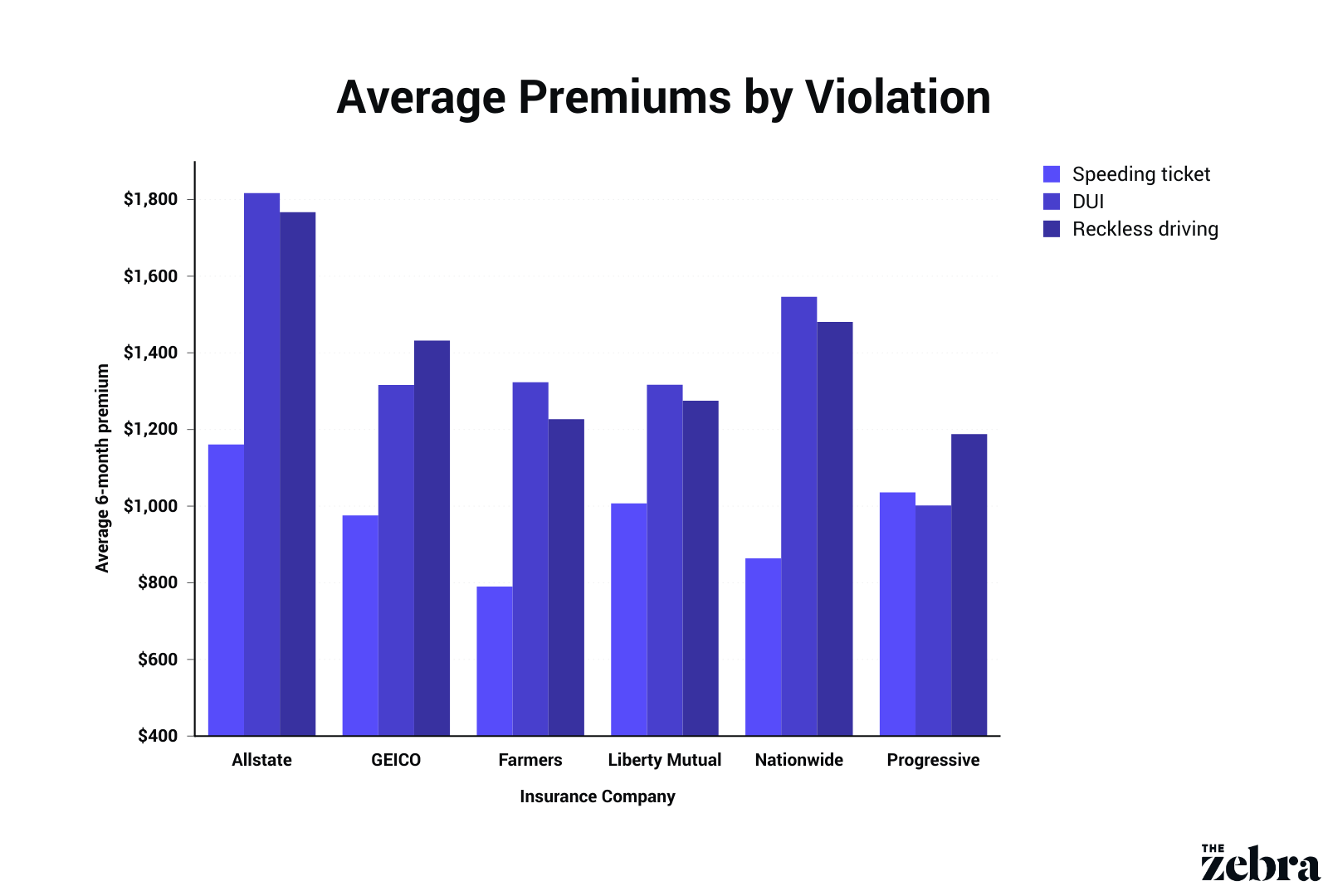

Where you live and where you park your car overnight may affect your car insurance premium. However if you are issued license points after an incident behind the wheel such as speeding DUI or distracted driving a drivers car insurance premiums will get more expensive. Traffic violations not only take a financial toll in the form of fines but they can also increase your car insurance premiumsup to a whopping 82 in some cases according to a study by insurance comparison website The Zebra.

Your insurance score which is similar to your credit score can significantly affect your premiums even the ability to secure a policy. Which one of the following policies mitigates the negative effects of moral hazard. The more easily car damage can be repaired the lower the premium-Your age.

Factors that can affect an auto insurance premium are-Value of the insured vehicle. And discounts for driver training. It is possible to lower costs by combining policies with your spouse.

The higher the value of the car the higher the premium-Repair record of the car. Which of the following do you think affects ones car insurance premium. Younger drivers have less experience and pay lower premiums c.

Mandatory car insurance for car owners. They could potentially even lead to your insurance company dropping your coverage altogether. Urban neighborhoods typically have higher rates of accidents theft and vandalism than more rural areas which means premiums may be higher.

The correct answer is that all of these factors can impact your car insurance premium. There are many factors that affect car insurance rates including your age gender where you live credit score and the type of car you drive. Increasing the insurance premium.

The main factors that influence the amount paid for auto insurance are the year make and model of automobile. A no claim discount counts the number of years that have gone by without you making a claim on your car insurance. Your driving history and habits.

Some insurance providers may charge you more to cover the additional risk. Driving record Even with a long insurance history careless driving habits can negatively impact your premiums. Oct 6 2021.

Which of the following is a factor that will affect your auto insurance premium. Other factors that affect the cost of your insurance. Married people on average pay 4 less than single drivers.

Insurance companies consider how much you drive before they set your rates.

Top 15 Factors That Affect Car Insurance Rates The Zebra

Insurance Companies Analyze A Vast Number Of Factors To Determine The Premiums Paid By Their Customers Some Of These Car Insurance Insurance Premium Insurance

0 Comments